Enterprise connectivity is going through a seismic shift driven by several factors. This Research Highlight identifies some of these industry shifts and provides strategic guidance for cloud hyperscalers and their ecosystem partners (telcos and interconnection partners) as they aim to meet the networking solution demands of the modern enterprise.

Registered users can unlock up to five pieces of premium content each month.

Enterprise connectivity is going through a seismic shift driven by several factors. This Research Highlight identifies some of these industry shifts and provides strategic guidance for cloud hyperscalers and their ecosystem partners (telcos and interconnection partners) as they aim to meet the networking solution demands of the modern enterprise.

Market Overview

- The increased adoption of public and private cloud solutions has been a result of the growing data storage/processing needs enterprises require as they digitally transform their operations.

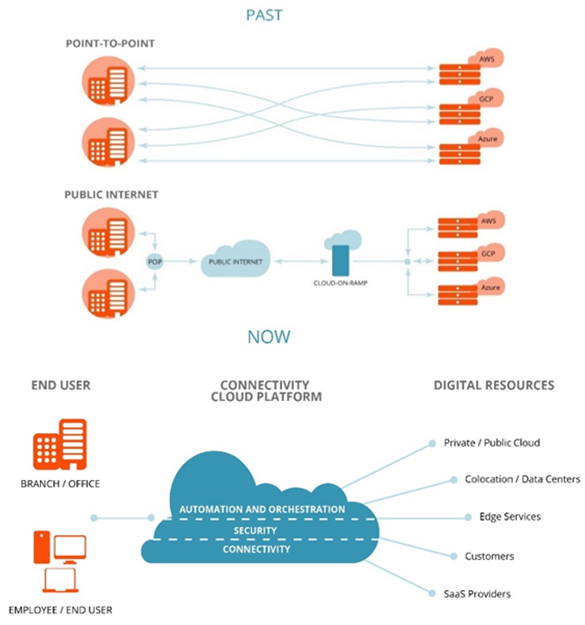

- Enterprises require new connectivity solutions that support greater agility, flexibility, security, performance, and redundancy to support their cloud operations than legacy point-to-point networks.

- To meet these growing demands, cloud hyperscalers have developed enterprise connectivity or networking solutions that dynamically connect enterprise endpoints (i.e., employee devices, branches, offices) with digital resources (i.e., public/private cloud applications, colocation data centers, customers, Software-as-a-Service (SaaS) applications).

- Currently, enterprise connectivity solutions do not differ greatly, but hyperscalers should adapt their mindset to view these as differentiators. Enterprise connectivity can help drive performance, reliability, and security for cloud applications. Developing partnerships, improving backbone connectivity, and investing in platform automation/reliability will help grow the enterprise cloud service customer base.

- Cloud competition is “heating up” in emerging regions. The cloud connectivity market in North America, China, and Western Europe is well defined with Amazon Web Services (AWS), Azure, and Google Cloud Platform (GCP) dominating. However, as cloud usage grows in Asia-Pacific, Latin America, and the Middle East & Africa, each cloud player needs to expand its presence to capture revenue opportunities—interconnection provider and telco partnerships will be a massive part of this strategy.

“Given that most enterprises deploy IT operations on either a private or public cloud, optimizing connectivity is an essential step for enterprises looking to drive business outcomes. It can help support product/site time-to-value, optimize cloud management/deployment costs, lower IT overheads, and mitigate against the risk of cybersecurity challenges. Achieving these outcomes requires connectivity services that offer high performance, redundancy, integrated security, global presence, and on-demand scalability.” – Reece Hayden, Analyst at ABI Research

The figure below highlights the key structural differences between a “legacy” and a “modern, cloud-delivered” enterprise connectivity framework.

Key Decision Items

The following sections provide recommendations for hyperscalers and ecosystem partners, as they develop enterprise connectivity solutions. The first three sections are for hyperscalers, and the next three are for ecosystem partners.

Set the Goal for Multi-Cloud Support

Enterprises are transitioning to multi-cloud policies for sovereignty, performance, redundancy, accessibility, and many other reasons. Cloud solution providers should follow Oracle’s lead and begin integrating with other connectivity players to embolden their enterprise value proposition. With Oracle Connect for Azure, these two public clouds work with seamless interoperability, enabling unified data management across clouds and combining the capabilities of two cloud vendors to optimize performance and cost.

Develop Channel Partners

Channel partners are crucial for technical and commercial reasons. Developing these partnerships and deepening strategic alignment should be the main priorities for cloud hyperscalers developing enterprise connectivity solutions. Telco operators and interconnection providers have the vital infrastructure, relationships with enterprises, access to technical partners, and networking expertise. Expanding these relationships can help hyperscalers expand cloud service provision without network investment.

Don’t Ignore the Edge

Ignoring the edge would be a mistake for hyperscalers. The edge market has been slow to mature, impeded by portability, accessibility, and visibility issues. However, as the edge market begins to mature, it is vital that cloud hyperscalers provide solutions that connect enterprises with edge services (e.g., AWS Outpost). Given that edge applications require high-performance networking solutions, hyperscalers must make this connectivity a priority.

Next, we provide three strategies for enterprise cloud connectivity ecosystem partners to leverage.

Enterprise Cloud Connectivity Ecosystem Partners Should Broaden Their Geographic Range

Interconnection solution providers should aggressively expand their geographic presence through infrastructure investment, Mergers and Acquisitions (M&A), and network backbone development. This market remains fragmented with a substantial opportunity for consolidation. First movers have a significant opportunity to benefit from the global multi-cloud transition. Their strategic focus should be on securing strong positions in developed regions and taking dominant roles in developing areas, such as Asia-Pacific, Latin America, and the Middle East & Africa

Make Automation a Priority

If telcos want to compete in the enterprise connectivity space, automation is key. As networks grow, managing them becomes more complex for enterprises. Automated and orchestrated connectivity solutions enable end-to-end control over the entire enterprise network from endpoint to application. This lowers management costs and aligns networking services with business goals.

Following the example of Console Connect and acquiring automation capabilities, knowledge, and skill sets should be the goal for telcos looking to compete in this highly lucrative enterprise connectivity space.

Leverage Telcos’ First Mile Ownership

Interconnection provider expertise, global presence, mature backbone, and leading platform automation puts them ahead of telcos as channel partners. However, telco ownership of the first mile should not be forgotten—this is especially important for mission/life-critical applications and will be needed for certain enterprises and digital resources.

While interconnection solution providers offer middle-mile connectivity through their private backbone, the first mile is a challenge. This is where telcos or carriers come in. They own the first mile through their network infrastructure solutions. This allows telcos to provide direct cloud connectivity to public cloud applications across underlying network connections, including Multiprotocol Label Switching (MPLS), Ethernet, Internet (with Dedicated Internet Access (DIA)/Virtual Private Networks (VPNs)), and even cellular.

Key Market Players to Watch

Dig Deeper for the Full Picture

ABI Research’s Hyperscaler Strategies for Enterprise Connectivity research report provides a breakdown of the enterprise connectivity ecosystem.

- First, it takes a deep dive into the technology, also looking at the demand side of the market and understanding the connectivity solutions enterprises want, and how hyperscalers can best drive their value proposition.

- Second, it evaluates each hyperscaler’s range of enterprise connectivity services.

- Third, it evaluates enterprise connectivity channel partners—interconnection providers and telcos—and offers strategic advice for each player in the ecosystem.

- Finally, the report offers more strategic recommendations for hyperscalers, as well as market expectations.

Not ready for the report yet? Check out our following Research Highlights:

- Facing Enormous Workloads, Public Clouds Turn to SmartNICs, DPUs, and IPUs

- How CSPs Should Set the Stage for NaaS

- Governments and Data Center Processor Companies Confronting Supply Chain Calamities

This content is part of the company’s Distributed & Edge Computing Research Service.